Nilesh Ved is one of the most powerful and least-profiled entrepreneurs in the international retail sector. Ved scaled, systems, and strategic brand partnerships may not bring him global recognition but Ved created a reputation of a billionaire without worrying about the media exposure, listing his stock on the stock market.

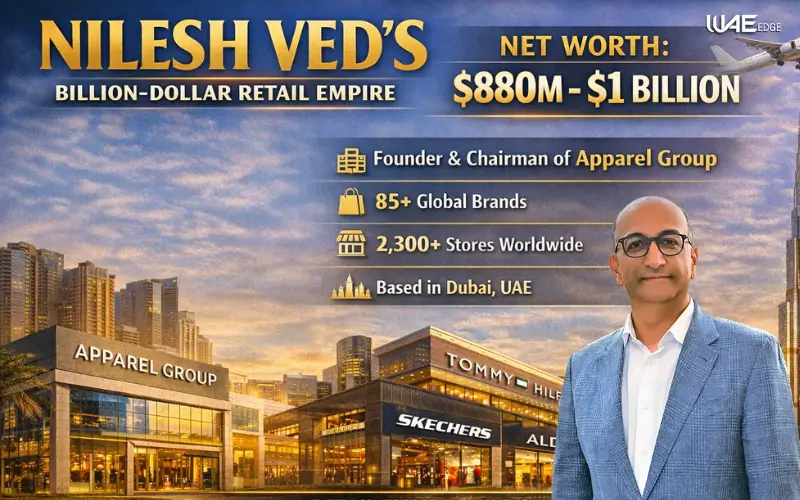

He is mostly recognized as the Founder and Chairman of the Apparel Group, a Dubai-based multinational retail conglomerate that owns and operates thousands of stores in the Middle East, Asia and the emerging global markets.

The main factors that make Nilesh Ved interesting to the world are:

- An entrepreneur of one of the biggest privately owned retail chains in the Middle East.

- Exclusive franchisee of the world-famous fashion and lifestyle brands.

- Creator of an unlisted business empire that is not hyped.

- Billionaire with an estimated operational wealth.

💰 Nilesh Ved Net Worth: Estimated Wealth in 2025–2026

Nilesh Ved’s net worth now ranges between eight hundred and eighty million and one billion USD. As the Apparel Group is privately owned, these values are determined based on the industry standards, revenue comparison, and asset valuation models.

His fortunes are not pegged on fluctuation of the stock market but are supported by:

- Apparel Group Majority ownership.

- Brand licensing deals with high values.

- Long-term real estate and retail real estate.

- Supply chain assets, logistics and warehousing.

- Multinational expansion rights.

This diversified arrangement makes his net worth stable and has a long-term growth potential.

Overview

| Category | Information |

| Full Name | Nilesh Ved |

| Nationality | Indian |

| Base of Operations | Dubai, UAE |

| Company Founded | Apparel Group |

| Role | Founder & Chairman |

| Estimated Net Worth | $880M – $1B |

| Industry | Retail, Fashion, Lifestyle |

| Total Stores | 2,300+ |

| Countries | 15+ |

| Brands Managed | 85+ |

Also Read: Ramneek Sidhu – Inspirational Entrepreneur and Digital Marketing Pioneer

🏢 Apparel Group: Support of Net Worth of Nilesh Ved

The main driver of the wealth of Nilesh Ved is Apparel Group. The company was established in 1999 to buy franchise rights rather than start in-house brands, which minimized the risk and increased growth.

Apparel Group has the following core strengths:

- Powerful mall relationships in GCC countries.

- Key retailing points within high pedestrian malls.

- Single point supply chain and inventory control.

- In-depth knowledge of local consumer behaviour.

- Quick cross-border scaling of brands.

It is this operational excellence that made Apparel Group a multi-billion-dollar retail operator.

🌍 Global Brands That Generate Massive Revenue

One of the key factors contributing to the rapid increase in Nilesh Ved’s net worth is the fact that Apparel Group possesses brands that are trusted across the world. These alliances will guarantee high demand, high pricing and steady foot traffic.

The main brands that Apparel Group runs are:

- Tommy Hilfiger

- Calvin Klein

- Skechers

- Aldo

- Crocs

- Levi’s

- Tim Hortons

- Birkenstock

The brands all add to the diversified revenue streams in the areas of fashion, footwear, and food and beverages.

🧠 Business Strategy That Sets Nilesh Ved Apart

Nilesh Ved has a long-term retail ecosystem strategy as compared to short-term profit seekers. His strategy revolves around sustainability, data and collaboration instead of hype.

The strategic concepts of the key points are:

- Moving into markets where the disposable income is increasing.

- Localization of global brands to the local culture.

- Making a significant investment in supply chain efficiency.

- Finding a balance between a premium and mass-market brand.

- Growing food/ beverage retailing and fashion.

- Empowering omnichannel and electronic trading.

This is a strategy that ensures that profits are cushioned even when the economy is undergoing a downturn.

☪ Assets, Investments and Wealth System

Nilesh Ved has diversified his wealth into various asset classes, making it less risky and more resilient.

His asset portfolio is said to consist of:

- Dubai real estate– residential luxuries.

- Business warehouses and retail stores.

- Infrastructure logistics in the long run.

- Fairness of the private retail business.

- Retail operations Technology investments.

Instead of wasteful spending on the population, the majority of his money is invested in the development of businesses.

📈 Why Nilesh Ved’s Net Worth Keeps Growing

The following structural trends endorse the further growth of Nilesh Ved’s net worth:

- India and Southeast Asia expansion.

- Expansion of athleisure and casual fashion companies.

- Growing the mall culture in the emerging markets.

- Travel retailing and airport growth.

- Increasing the need for international brands.

- Combining e-commerce and brick-and-mortar outlets.

These have placed Apparel Group in a position for long-term growth in valuation.

🔍 How He Compares to Other Retail Billionaires

Although most retail billionaires depend on the stock market listing, Nilesh Ved has an advantage:

- Concentrated ownership

- Operational control

- Less exposure to stock market risk.

- Faster decision-making

This renders his fortune more concentrated and undiluted compared to publicly traded retail founders.

🧾 Final Analysis: Why Nilesh Ved Is a Retail Giant

The success of Nilesh Ved is evidence that money worth billions of dollars can be made by systems, alliances, and persistence as opposed to publicity. His empire is also among the strongest privately owned retail networks in the world.

As Nilesh Ved’s net worth grows due to further growth and intelligent brand alliances, his status as one of the most powerful retailers in the world will only get better.

Also Read: Salama Alabbar Emirati Entrepreneur in Luxury Fashion and E-commerce

FAQs

Nilesh Ved is expected to have what net worth?

He has an estimated net worth of $880 million -1 billion USD.

What firm has turned Nilesh Ved into a rich man?

He made his fortune with Apparel Group, a retail conglomerate that invested all over the world.

Is Apparel Group a publicly traded company?

No, it is a privately owned firm.

Where does Nilesh Ved live?

His base is mainly in Dubai, UAE.

Is he an outsourced investor?

Yes, primarily in the property, logistics, and individual projects.