Introduction

The UAE’s residents and employees should make it a habit to manage their salary accounts. Rent, groceries, transportation, savings, and other expenses require that you always know the amount of money in your bank account. First Abu Dhabi Bank (also known as FAB Bank) is one of the largest and trusted banks in this region. FAB is the bank of choice for many UAE companies.

For account holders, one common question is: how can I check my FAB Bank salary account balance online? FAB offers a range of options to check your account balance safely and quickly. There are many convenient methods available, whether you use mobile apps, Internet Banking, SMS Alerts, or visit an ATM.

The guide below will explain how to access your FAB balance check online or offline and what you can do to view the balance.

FAB Salary Account

Salary accounts are a special type of account that is created to receive monthly salaries. FAB Bank is the bank of choice for thousands of UAE workers, professionals,, and expats.

FAB Salary Account Features

- Direct Salary Deposit: The employer deposits the salary directly into your account every month.

- You can get a free debit card for online purchases and withdrawals.

- FAB Digital platforms allow users to check their balance online, pay bills, and transfer money.

- Services Linked: This account is linked to credit cards, savings plans, and loans.

- You can access your account 24/7 through mobile banking and online banking.

A salary account at FAB allows you to take control of your finances with ease.

Why It’s Important to Check Your Salary Account Balance

Most account holders only check their balance when they withdraw cash at an ATM. Regularly monitoring your salary account has many benefits:

1. Budget Management

Keep track of what you earn so you’ll know exactly how much money you have to spend or how much savings you need.

2. Tracking salary credits

You can check your account balance to confirm your pay has been received on time.

3. Monitor Expenses

The balance of your account and the mini-statements will show you how much money has been spent on shopping, bills, or transfers.

4. Avoiding Overdraft or Insufficient Funds

Checking your balance regularly can help you avoid declined transactions and penalties for a low balance.

Checking your FAB account regularly will help you to maintain financial discipline and reduce stress.

FAB Bank Online Salary Account Balance Check

FAB has made significant investments in the digital banking service. Online methods will be the most convenient for you if you like modern, fast solutions.

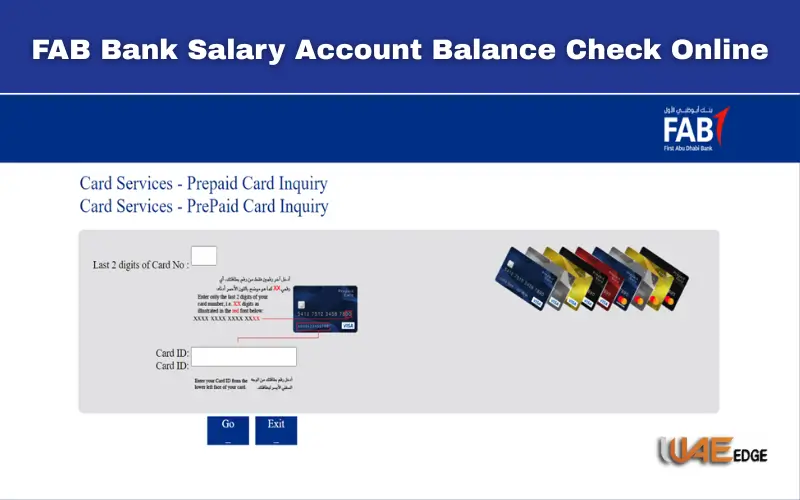

FAB Online Banking Portal

FAB’s online banking platform is the one most frequently used by clients.

Check your balance online using our web portal.

- Bankfab.com is online.

- Please enter your Username and Password.

- You can verify your identity by using the code that is sent to your phone.

- Go to Accounts once you are logged in.

- You will see your balance and recent transactions.

FAB Online Banking: Features and Benefits

- Balance enquiry

- Monthly Statements can be downloaded.

- Transferring funds within FAB or to another bank is possible.

- Payment of utility bills and other charges

Tip: Log out immediately after you have completed your balance, particularly if the device is shared.

FAB Mobile App

FAB Mobile App offers the best option to those who wish to keep track of their account balances on the move.

Use the App to check your balance:

- FAB Mobile App is available on Google Play and Apple App Store.

- Register using the FAB Customer ID or Debit Card Number.

- Set your login credentials.

- Sign in to the app.

- You can see the balance of your account on the homepage.

Apps with other features:

- Transferring money is easy.

- Payments by credit card

- Managing debit/credit cards.

- Applications for loans

- You can check your previous earnings by checking the salary credit.

The app allows you to check your balance instantly and at any time.

SMS Alerts and Banking

FAB sends you SMS notifications whenever your salary has been credited into your account. It is a simple way to verify salary deposits, without having to log in to your online banking.

What SMS alerts can do for you

- Notification of salary crediting is instant.

- The latest information on deposits, withdrawals, and transfers.

- How to quickly check if you have a low balance.

To receive alerts, you must register your phone number. Depending on your plan, you may be able to send SMS commands.

FAB WhatsApp Banking

FAB offers innovative services in the UAE, such as WhatsApp Banking. You can register your phone number and chat with FAB’s official WhatsApp number for account information, such as balance.

Steps:

- Save FAB’s official WhatsApp Number from their website.

- You can send “Hi” to your mobile phone number.

- You can follow the instructions of a chatbot.

- Choose the option “Check Balance”.

The method works 24 hours a day and is safe.

Linking with Digital Wallets

FAB accounts for salary can be connected to Apple Pay, Google Pay, or Samsung Pay. These wallets can be used for transactions, but you may also view the linked card balance and recent transactions to get a quick overview of your finances.

How to check the FAB salary account balance offline

Digital banking is not for everyone. FAB offers both traditional and online methods.

FAB ATM Balance Inquiry

FAB ATM is the simplest offline method.

Steps:

- Use your FAB card to withdraw cash from an ATM.

- Enter your PIN.

- Choose Balance Inquiry in the menu.

- Your current balance will be displayed on the screen.

You can also print a mini-statement to keep track of your recent transactions.

Visit a FAB Branch

You can visit any FAB branch if you want personalized service. A teller at the FAB branch can provide you with account information and check your balance. Self-service kiosks are available in some branches.

Contacting Customer Service

After verifying your ID, FAB can give you your account balance.

Steps:

- Contact FAB Customer Care by calling the FAB number.

- Please enter your account or card number.

- Answer security questions to confirm your identity.

- Ask for a balance enquiry.

You can use this if you don’t have mobile or internet access.

Problems that are common and how to fix them

1. You forgot your Online Banking Password

You can reset your password by clicking the Forgot Password link on the login screen.

2. Mobile App Not Working

You can update the app from the App Store or install it again.

3. No Salary Credit

Contact your employer or FAB Customer Service.

4. No SMS alerts received

Verify that your FAB number is active and registered.

5. Internet Banking Login Problems

Try clearing your cache on another browser or logging in using a different device.

Secure Checking of Balances Online

Follow these security measures to protect sensitive financial information:

- Do not log on to public Wi-Fi.

- Never share your PIN or password with anyone.

- Enable two-factor authentication.

- After checking your account balance, log out.

- Download apps from the official store.

FAB Salary Account Services

Checking the balance of your account is just one aspect of maintaining your payroll. FAB also offers services like:

- Get a portion of your pay before payday.

- Approval of Personal Loans is easy when linked to your salary.

- Direct International Transfers: You can send money directly to another country from your bank account.

- FAB Bill Payments allows you to pay your DEWA, Etisalat, or Du bills.

The management of salary accounts is made easier and more flexible with these services.

The User Experience – Example – Online Balance Check

Imagine you’re an employee who just received your monthly salary in Dubai. Check your balance by using the following method:

- Open the FAB Mobile App from your smartphone.

- Enter your login details.

- Your balance is immediately updated on the home page.

- To confirm your salary credit, you can open the statement section.

- Download the PDF statement for your own records.

The process is simple and takes only two minutes. You will have peace of mind knowing that you are in control.

Get Cashback for Salaried Customers

FAB offers cashback to salaried people in addition to its easy banking service. You can receive up to AED 5,00 in cashback by transferring your salary into FAB. This depends on your nationality and salary bracket.

Cashback Earning Levels

| Monthly Salary (AED) | Cashback for UAE Nationals | Cashback for Expatriates |

| 0 – 2,999 | 0 | 0 |

| 3,000 – 4,999 | Up to AED 1,000 | Up to AED 500 |

| 5,000 – 14,999 | Up to AED 2,500 | Up to AED 1,500 |

| 15,000+ | Up to AED 5,000 | Up to AED 2,500 |

How it works:

- Your FAB Account will receive your salary each month.

- You are eligible for a second deposit if you have two consecutive salary deposits.

- The FAB Reward that you receive as a cashback can be used for:

- Shop at partner stores.

- Salik Tolls and Bills

- You can redeem your vouchers for cash and deposit them directly to your account.

The offer allows you to receive an additional salary while keeping your current account.

Conclusion:

It is easy, quick, and secure to FAB Bank salary account balance online. You can access your salary information using the FAB Mobile App or the online banking portal.

The FAB Mobile App offers the fastest and easiest option for most users. ATMs and Customer Service remain the best offline options. Checking your account balance regularly helps track expenses and manage salary credits. It also prevents financial surprises.

FAB is a bank that has a solid reputation for being a customer-friendly, modern institution. Its digital services allow you to manage your account from anywhere.

Related Blogs:

Card Activation FAB Debit Card

Unlinking FAB App Step-by-Step Guide

FAB iSave Account Explained High-Interest Zero-Fee Savings in UAE

FAQs

Q1. How can I sign up for FAB Online Banking?

Click on the “Register” button and enter your debit or credit card number.

Q2. Can I check my FAB balance on the internet?

You can do this through SMS, ATM balance inquiries, or customer service.

Q3. Is the balance inquiry fee charged?

Checking the balance on FAB official channels is generally free. Using ATMs that are not FAB-affiliated may incur small charges.

Q4. How do I know if my salary has been credited?

If you want to check, either send an SMS or use the FAB app on your mobile device or at an ATM.

Q5. Can I check my FAB balance outside the UAE?

FAB’s mobile and online banking app is available worldwide.